Straight forward, witty and timeless. #TellItLikeItIs, is a blog for our generation![]()

Money, money, money. Everyone wants more money. Everyone says they need more money and need it now. But how exactly does someone strategize to get more cash in hand or what steps can someone take to boost his or her financial standing at the very basic level?

We’ve taken into account the possibility that you’re on a shoestring budget and have come across the best first step investments you can make to see some financial returns.

Firstly, you need to be disciplined when it comes to saving money. We know this can be hard and sometimes it is a struggle to choose between needs and wants, but trust me, being frugal with your spending is worth it. If you need more help you can enlist your friends and family to hold you accountable so you don’t spend unnecessarily. With this money you put away you can use it to invest in a venture of your choice which earns some financial rewards.

If you have trouble holding yourself accountable, you can always turn to the bank to help with your savings. Set up a system whereby a set percentage of your salary immediately goes towards a savings account. That way, there is a portion of your monthly income which you can’t touch because it’s safely tucked away. When the time comes you can then access these funds and put it towards a worthwhile investment of your choice.

Now that we’ve gotten the savings aspect out of the way, let’s look at how these savings can be wisely invested. There are numerous avenues for investing, especially in today’s modern world and advancement in technology. This article however shares suggestions for those who have never considered investing in the past and want to test it out at a very basic level first before diving in.

Gain Interest

Since we’ve spoken about the bank being involved in your saving project we’d suggest you take it a step further by ensuring you have a fixed deposit. One key difference between a fixed deposit and a savings account is that a fixed deposit account is a sort of investment, where the money is deposited for a particular period of time and the bank pays interest on the money deposited, unlike a savings account which can be easily accessed for personal use. The interest gained on a fixed deposit is much higher than that of a savings account, and you can acquire this interest at the end of the term of the fixed deposit while choosing to leave the money which was initially deposited, untouched.

Buy Shares

Another great investment is buying shares in a local company. Be sure to do your research on this one first. Choose wisely, see which company generally reports a profit at the end of each financial year then buy some shares in that company. This way you can reap some of the financial benefits from the earnings made by and own a part of – the company.

The payment of dividends to you the shareholder is one of these great benefits. A dividend is the distribution of some of a company’s earnings to a class of its shareholders. These payments can provide you with regular investment income and enhance your return. And you may be wondering : where do I get the money to buy shares in a company? Easy answer: the money we encouraged you to save at the very beginning.

The 2 strategies outlined are routes that will take some time to see returns. But that’s why it’s called a ‘money tree’, it takes nurturing. But growing your money is an important, well thought out process, to ensure you reap maximum benefits.

Warnings about Quick schemes

You may be thinking, even at the basic level isn’t there an easier way to grow my money? Like some super inorganic fertilizer that I can just pump in the soil to make my money tree bloom a little bit quicker? For instance, what about playing the Lottery? Well yes, even that is an existing investment option to gain money quickly; that is if you win. But with every investment there are risks and with these types of investments, greater risks exist. What if perhaps you invest and invest for years but never win more than $10? Also, at what point do you evaluate the money spent vs. the rewards gained? Now I’m not saying don’t play the lottery, but just do so understanding your investment’s risks, having a strategy and being mindful that you may not get the ‘Super Six Jackpot’ for the next few years if ever.

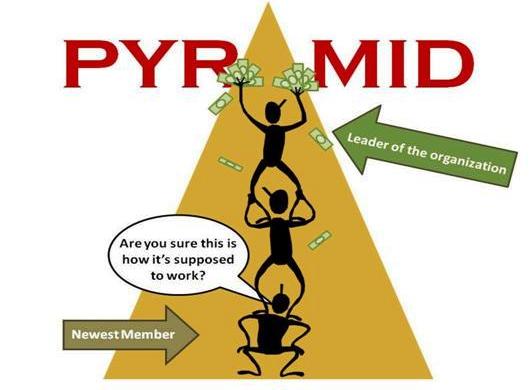

Finally, here are two more words to consider – ‘Pyramid schemes’. A pyramid scheme is a sketchy and unsustainable business model, where a few top-level members recruit newer members. Those members pay upfront costs up the chain to those who enrolled them. As newer members in turn recruit underlings of their own, a portion of the subsequent fees they receive is also kicked up the chain (from investopedia.com). These get rich quick strategies seldom work and come in various packages, but the same concept exists. So, be alert. While it is enticing to be told you can invest fifty dollars and get three hundred in a week (If I had a penny for every time I heard a ‘great’ offer like that), just pause, think for a moment and weigh the pros and cons.

We wish you all the best in your financial investment ventures and hope these tips were helpful in setting you on the right path as a beginner.

Written by: Andrea Louis

For: Generation Y Dominica